How can NRN Property Transfer in Nepal?

NRN Services & Consulting provides the best legal and financial services with time-saving tasks and quality in Nepal dedicated to Non-Resident Nepali along with 20 Years of Combined Global Expertise. This Article has covered the Procedure, Questionnaire, Time, Fee and the relevant details for transferring Property by NRN in Nepal.

Can NRNs transfer property in Nepal?

Yes, Non-Resident Nepalis (NRNs) can transfer property in Nepal. The legal framework governing property rights for NRNs permits them to transfer ownership through sale, gift, or inheritance. However, this process must comply with the regulations outlined by the Government of Nepal. NRNs are required to adhere to the Foreign Investment and Technology Transfer Act, the NRN Act, and related property laws. NRNs must ensure all financial transactions related to the property transfer are conducted through proper banking channels.

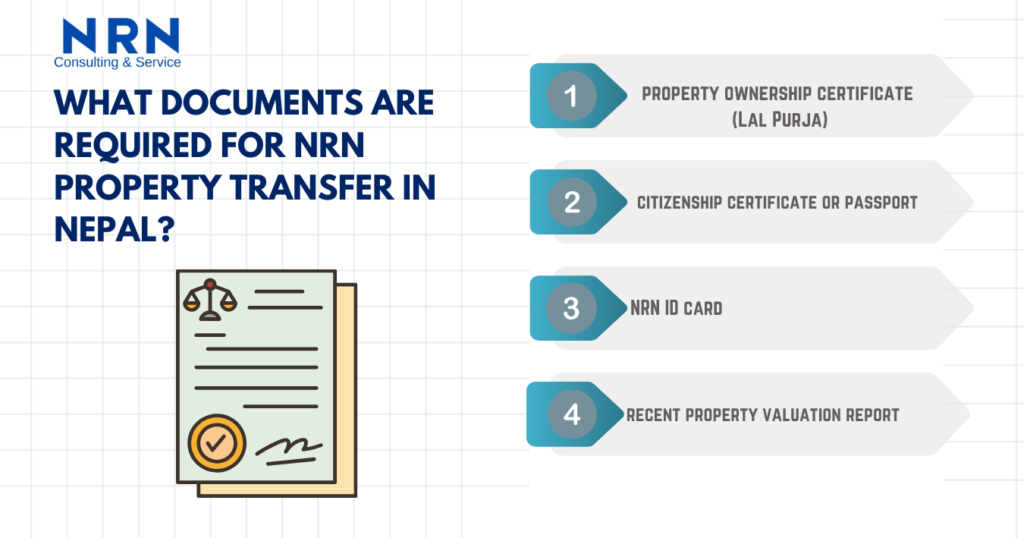

What documents are required for NRN Property Transfer in Nepal?

Specific Documents are necessary in Nepal to conduct efficient transfer of Property. The primary documents include the property ownership certificate (Lal Purja), which verifies the seller’s ownership. Additionally, the land revenue receipt must be presented to demonstrate that all taxes related to the property have been paid. A government-issued identification card, such as a citizenship certificate or passport, is required for both parties involved in the transfer. NRNs must also provide their NRN ID card.

A recent property valuation report, obtained from the Land Revenue Office, is essential to establish the current market value of the property. If the property is being transferred through inheritance, a legal heir certificate and consent from all legal heirs are necessary. Moreover, a sale agreement, detailing the terms and conditions of the transfer, must be drafted and signed by both parties.

A Notary Public must validate and authenticate these documents.

How to initiate NRN property transfer in Nepal?

First, the seller must verify that they possess clear and undisputed ownership of the property. This is done by confirming the property ownership certificate (Lal Purja) and ensuring all taxes are up-to-date with the land revenue receipt. The next step involves drafting a sale agreement, outlining the terms and conditions agreed upon by both parties.

Subsequently, both parties must visit the Land Revenue Office to submit the necessary documents, including identification cards, NRN ID (for NRNs), and the property valuation report. The Land Revenue Office will then verify the documents and calculate the applicable taxes and fees. After paying these fees, the office will facilitate the transfer of ownership, updating the property records to reflect the new owner.

Are there fees for property transfer?

Yes, transferring property in Nepal involves several fees that must be paid to facilitate the process. The primary fee is the registration fee, calculated as a percentage of the property’s current market value. This fee is payable to the Land Revenue Office during the finalization of the transfer. Additionally, there is a capital gains tax, applicable if the property is being sold for a profit. The tax rate varies depending on the nature of the property and the duration of ownership. Legal fees must be considered if the services of a lawyer or notary public are utilized to ensure the proper drafting and authentication of documents.

How long does property transfer take?

The duration of property transfer in Nepal can vary based on several factors although NRN Services & Consulting can conduct the whole transaction within a Week or less. Generally, the process can take anywhere from a few weeks to a couple of months. Initially, obtaining and verifying all required documents, such as the property ownership certificate, land revenue receipts, and identification documents, can take some time.

Drafting the sale agreement and having it reviewed by legal professionals may also require additional days. Once the documentation is complete, submitting them to the Land Revenue Office for verification and processing is a crucial step.

The office will conduct a thorough review, calculate taxes and fees, and then facilitate the transfer of ownership.

Can property be transferred online?

As of now, property transfer in Nepal cannot be fully executed online. While some preliminary steps and document submissions might be facilitated through online platforms, the finalization of the transfer process requires physical presence and verification at the Land Revenue Office.

The digitization of property records and related services is in progress, and certain tasks like checking property details, obtaining valuation reports, and paying some taxes can be conducted online.

However, the verification of documents, signing of the sale agreement, and payment of registration fees, necessitate in-person visits. Both parties involved in the transaction, along with their legal representatives, must appear at the Land Revenue Office to complete these formalities.

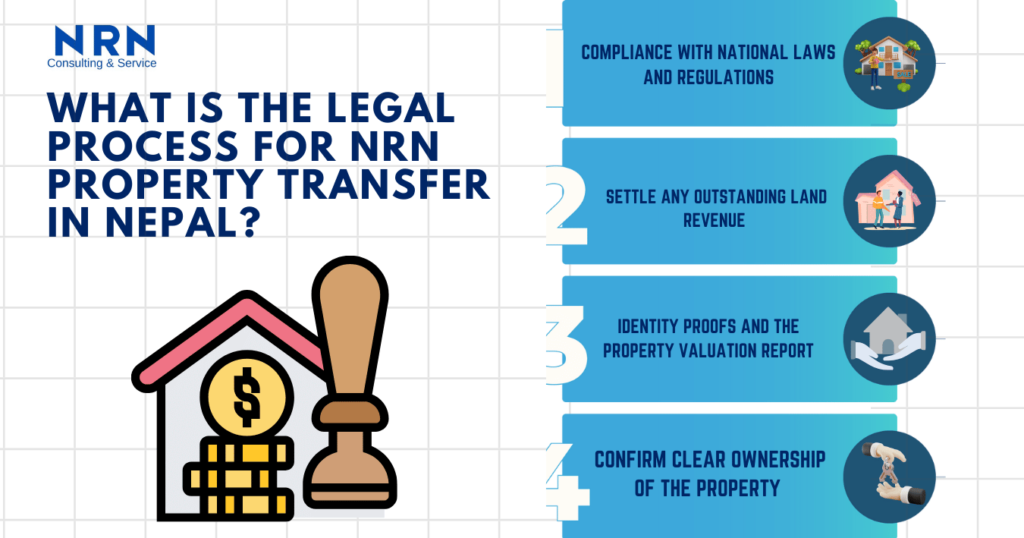

What is the legal process for NRN Property Transfer in Nepal?

The legal process for transferring property in Nepal involves several key steps to ensure compliance with national laws and regulations. Initially, the seller must verify ownership by presenting the property ownership certificate (Lal Purja). The next step is to settle any outstanding land revenue by providing the latest land revenue receipt.

Both parties must then draft and agree upon a sale agreement, outlining the terms and conditions of the transfer. This agreement should be reviewed by legal professionals to ensure its validity.

The involved parties must submit the necessary documents, including identity proofs and the property valuation report, to the Land Revenue Office. This office will verify the documents, calculate the applicable taxes and fees, and facilitate their payment.

Can NRNs transfer property to locals?

Yes, Non-Resident Nepalis (NRNs) can transfer property to local Nepali citizens. The process for transferring property from an NRN to a local follows the same legal framework as any property transfer within Nepal. The NRN must first confirm clear ownership of the property by presenting the property ownership certificate (Lal Purja) and ensuring all land revenue taxes are up-to-date.

Are there taxes on property transfer?

Yes, there are several taxes associated with property transfer in Nepal. The primary tax is the capital gains tax, which is applicable if the property is being sold for a profit. The rate of this tax depends on the type of property and the duration of ownership. Additionally, a registration fee must be paid to the Land Revenue Office, calculated as a percentage of the property’s market value. This fee is necessary for the official recording of the transfer.

How to verify property ownership?

Property can be verified in Nepal by examining Key Documents and Records in the Land Revenue Office and the Courts. The primary document to check is the property ownership certificate, commonly known as the Lal Purja. This certificate confirms the legal owner of the property. It must be confirmed that all taxes regarding the Property has been paid through the Inland Revenue Department.

Can property be gifted?

Yes, property can be gifted in Nepal, and the process involves legal formalities to ensure the transfer is recognized and valid. The person gifting the property, known as the donor, must have clear ownership of the property, confirmed by the property ownership certificate (Lal Purja). A gift deed must be drafted, detailing the property being transferred and the terms of the gift.

This deed must be signed by both the donor and the recipient (donee) and witnessed by at least two individuals. The gift deed should be registered with the Land Revenue Office to make the transfer legally binding.

The registration involves submitting the gift deed along with the property ownership certificate, land revenue receipts, and identification documents of both parties. The Land Revenue Office will verify the documents, calculate any applicable taxes or fees, and update the property records to reflect the new owner. Partition of Property can also be conducted.

What are the rights of NRNs in property transfer?

Non-Resident Nepalis (NRNs) have specific rights regarding property transfer in Nepal, protected under the NRN Act and related property laws. NRNs are entitled to own and transfer property in Nepal, similar to the rights of resident Nepali citizens.

They can sell, gift, or bequeath their property to others, including both NRNs and local Nepalis. NRNs must provide their NRN ID card, issued by the NRN Association, as proof of their status when engaging in property transactions. This ID card allows them to exercise their property rights without restrictions.

Furthermore, NRNs are subject to the same legal and tax obligations as resident property owners, including payment of capital gains tax and registration fees during property transfer. They also have the right to legal recourse in case of disputes or issues arising from property transactions.

How to transfer inherited property?

The Inherited Property can be transferred as follows:

Initially, the heir must obtain a legal heir certificate from the local ward office to legitimize the claim of the Inheritance. Then, the Property Ownership Certificate of the deceased with land revenue receipts must be submitted. These documents must then be presented to the Land Revenue Office, where the heir will file an application for the transfer of ownership. The office will review the submitted documents, verify the heir’s claim. Additionally, if there are multiple heirs, a consent letter from all legal heirs is required, agreeing to the transfer.

Can NRNs sell their property?

Yes, Non-Resident Nepalis (NRNs) have the right to sell their property in Nepal. The process is similar to that for resident Nepalis Firstly, the NRN must ensure that their property ownership certificate (Lal Purja) and land revenue receipts are up-to-date and free of encumbrances.

The NRN must provide their NRN ID card, which verifies their status as a non-resident. A sale agreement detailing the terms and conditions of the sale must be drafted and signed by both the seller and the buyer. The Sale can be conducted in the Land Revenue Office.

What is the role of a notary in transfer?

A Notary Public is required o authenticate the legality of the Land Transaction during Property Transfer in Nepal. The Notary must verify the identities of the Parties involved along with the documents such as Sale Agreement, Gift Deed or Legal Heir Certificate. The Notary must also maintain the Legal Standards and Regulations set by the Land Revenue Office and other relevant authorities.

Are there restrictions on property transfer?

Yes, there are certain restrictions on property transfer in Nepal to ensure compliance with national laws and regulations. One primary restriction is related to the type of land being transferred; agricultural land, for instance, has specific regulations. Transfers involving minors or individuals with legal disabilities require court approval to ensure the transfer is in their best interest. Additionally, foreign nationals, except for Non-Resident Nepalis (NRNs), are generally restricted from owning land in Nepal. NRNs, while having broader rights, must provide their NRN ID card to prove their status

Can NRNs lease their property?

Yes, Non-Resident Nepalis (NRNs) can lease their property in Nepal. The process is similar to that for resident Nepalis. The lease agreement, detailing the terms and conditions, such as the duration of the lease, rental amount, and responsibilities of both parties, must be drafted and signed by both the lessor and the lessee.

How to resolve property transfer disputes?

Property Transfer Disputes can be resolved fairly through a legal Resolution. Initially, the parties involved should attempt to settle the dispute amicably through negotiation. If this fails, mediation by a neutral third party, such as a professional mediator or community leader, can help facilitate a resolution. Should mediation not yield a result, the next step is to seek legal recourse by filing a case in the appropriate court. The court will review the evidence, hear testimonies from both parties, and render a judgment based on the merits of the case. Additionally, the Land Revenue Office may be involved in verifying property records

Can NRNs transfer property to relatives?

Yes, Non-Resident Nepalis (NRNs) can transfer property to their relatives in Nepal. The NRN must provide their NRN ID card to confirm their status. The property ownership certificate (Lal Purja) and land revenue receipts must be up-to-date and free of encumbrances. A transfer deed, detailing the terms and conditions of the transfer, must be drafted and signed by both parties. If the transfer is being made as a gift, a gift deed should be prepared, specifying the relationship and the intent of the transfer. Both the transfer deed and the gift deed, if applicable, must be registered with the Land Revenue Office to make the transfer legally binding.

Conclusion

NRN Services & Consulting offers top-notch legal and financial services in Nepal, catering to Non-Resident Nepalis with over 20 years of combined global expertise. This article details the procedure, required documents, fees, and timelines for property transfer by NRNs in Nepal. It explains the legal framework, including how NRNs can transfer property through sale, gift, or inheritance, and the involvement of the Land Revenue Office.

FAQs

Can NRNs transfer property in Nepal?

Yes, NRNs can transfer property in Nepal through sale, gift, or inheritance, following legal guidelines.

What documents are required for NRN property transfer in Nepal?

1. Lal Purja (Land Ownership Certificate)

2. Land Revenue Receipts

3. NRN ID Card

4. Citizenship of Individual the Property is to be Trasferred

5. Valuation Report

6. Land Sales Agreeement

How to initiate NRN property transfer in Nepal?

Step 1: Obtain NRN ID Card

Step 2: Verify Ownership of Property

Step 3: Draft a Property Sales Agreement

Step 4: Submit Documents to Land Revenue Office

Step 5: Transfer of Land and Property

Are there fees for property transfer?

Yes, registration fees based on property value and capital gains taxes apply.

How long does property transfer take?

Typically weeks to months, depending on document verification and office processing times.

Can property be transferred online in Nepal?

Not entirely; physical presence at the Land Revenue Office is necessary for finalization.

How to verify property ownership in Nepal?

Check Lal Purja and verify tax payments at the Land Revenue Office.