NRN Investment Repatriation from Nepal

NRN Services & Consulting provides Expert Foreign Investment and Repatriation Services to Non-Resident Nepali and Foreign Citizens to and from Nepal. Our 20 Years of Combined Global Expertise backs our practices. This Article has covered the procedure, documents, eligibility, time, and additional requirements for NRN Investment Repatriation from Nepal.

Can NRNs repatriate investments from Nepal?

Yes, Non-Resident Nepalis (NRNs) can repatriate investments from Nepal. The Central Bank of Nepal, Nepal Rastra Bank (NRB), allows NRNs to transfer funds back to their country of residence.

It includes the repatriation of dividends, profits, sale proceeds of shares, and other investment returns. NRNs must adhere to specific guidelines and procedures set forth by the NRB to facilitate the repatriation process.

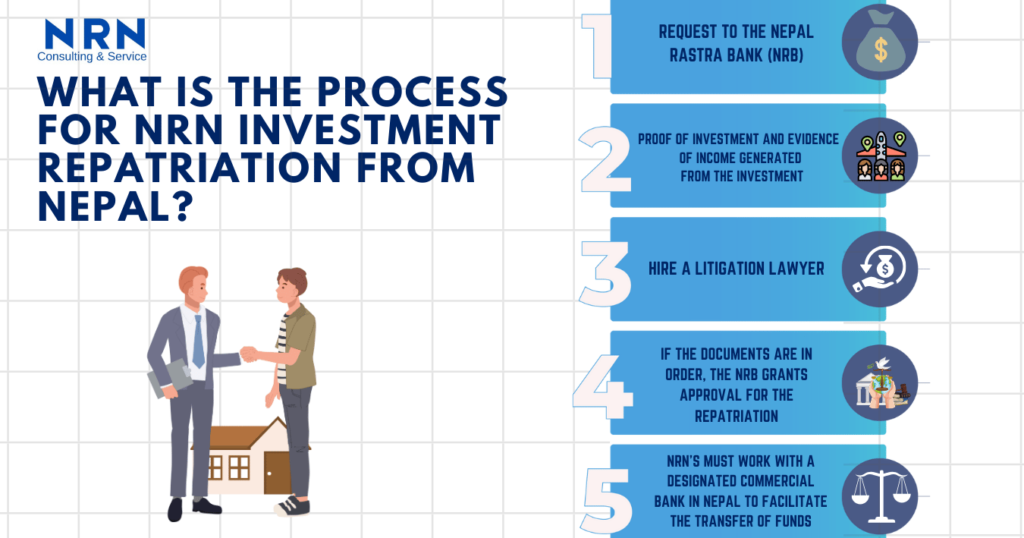

What is the process for NRN Investment Repatriation from Nepal?

The repatriation process for NRNs involves several key steps.

First, NRNs must submit a repatriation request to the Nepal Rastra Bank (NRB), the central bank of Nepal. This request must include all necessary documents, such as proof of investment and evidence of income generated from the investment.

Upon receiving the request, the NRB reviews the submitted documents to ensure they comply with Nepalese regulations. If the documents are in order, the NRB grants approval for the repatriation.

Following this approval, the NRNs must work with a designated commercial bank in Nepal to facilitate the transfer of funds. The commercial bank assists in converting the funds to the desired currency and transferring them to the NRNs’ foreign bank accounts.

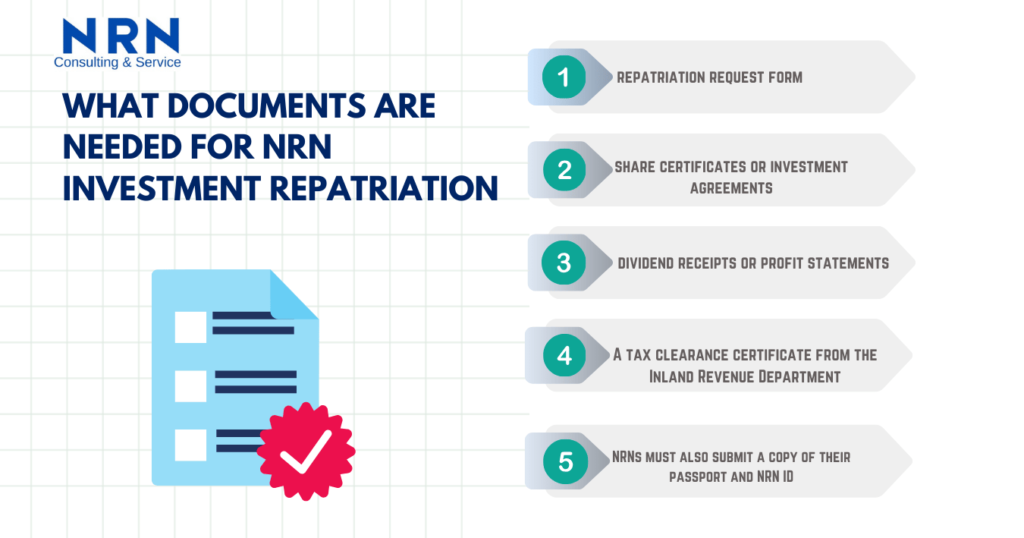

What documents are needed for NRN Investment Repatriation?

NRNs need to provide several documents to repatriate investments from Nepal. These documents include the repatriation request form, which is submitted to the Nepal Rastra Bank (NRB). NRNs must also provide proof of the original investment, such as share certificates or investment agreements.

Additionally, evidence of income generated from the investment, like dividend receipts or profit statements, is required. A tax clearance certificate from the Inland Revenue Department of Nepal is necessary to demonstrate that all applicable taxes have been paid.

NRNs must also submit a copy of their passport and NRN ID card. If the investment was made through a company, the company’s financial statements and board resolution approving the repatriation are needed.

Are there any repatriation restrictions?

Yes, there are certain restrictions on repatriation from Nepal. The Nepal Rastra Bank (NRB) imposes limits on the amount of funds that can be repatriated within a certain period. These limits are subject to change based on economic conditions and government policies. Additionally, repatriation is subject to compliance with tax regulations, and any outstanding taxes or liabilities must be settled before repatriation can occur. Certain types of investments, such as real estate, may have specific repatriation restrictions or requirements.

How long does repatriation take?

The duration of repatriation from Nepal varies depending on several factors. Once all required documents are submitted to the Nepal Rastra Bank (NRB) and approval is granted, the actual transfer of funds typically takes a few business days. However, additional time may be required for verification of documents and compliance checks by the NRB. Delays can occur if there are any discrepancies or incomplete information in the repatriation request.

Can repatriation be done online?

No, the Complete Process of Repatriation cannot be facilitated online although consultations, Strategy, Discussions can be conducted online. Non-Resident Nepalis (NRNs) can initiate the repatriation process by submitting their request electronically to the Nepal Rastra Bank (NRB) through the bank’s online portal in the future.

Are there repatriation fees?

Yes, there may be repatriation fees associated with transferring funds out of Nepal. These fees typically vary depending on the amount being repatriated and the financial institution facilitating the transfer. Commercial banks or remittance service providers may levy charges for processing repatriation transactions, including currency conversion fees and service charges. Additionally, the Nepal Rastra Bank (NRB) may impose regulatory fees or charges for approving and overseeing the repatriation process.

What are the tax implications?

The repatriation of funds from Nepal may have tax implications for Non-Resident Nepalis (NRNs). Income generated from investments, such as dividends, profits, or capital gains, is subject to taxation in Nepal. NRNs are required to pay applicable taxes on their investment income before repatriating funds. Additionally, any gains realized from the sale of assets, such as shares or property, may attract capital gains tax. However, Nepal has double taxation avoidance agreements with several countries, which can mitigate the tax burden for NRNs.

How to get NRN Investment Repatriation approval?

First, NRNs need to complete a repatriation request form available from the NRB or designated commercial banks. Along with the form, NRNs must provide supporting documents, including proof of investment, evidence of income generated, tax clearance certificates, and identification documents. These documents are submitted to the NRB for review and approval.

The NRB evaluates the request and verifies the authenticity of the provided information to ensure compliance with Nepalese regulations. Upon successful review, the NRB grants approval for repatriation, allowing NRNs to transfer funds out of Nepal through designated banking channels.

Can profits be repatriated?

Yes, profits generated from investments in Nepal can be repatriated by Non-Resident Nepalis (NRNs). The Nepal Rastra Bank (NRB) allows NRNs to transfer profits earned from various investments, such as dividends, interest, or capital gains, back to their country of residence. However, repatriation of profits is subject to compliance with Nepalese regulations and tax laws.

What are the repatriation limits?

The repatriation limits for Non-Resident Nepalis (NRNs) vary depending on the type of investment and prevailing regulations set by the Nepal Rastra Bank (NRB). NRNs are allowed to repatriate a certain amount of funds annually, subject to compliance with applicable laws and regulations. While there may not be specific limits on repatriating profits or returns on investment, NRNs must adhere to overall repatriation limits imposed by the NRB.

How to transfer funds internationally?

Non-Resident Nepalis (NRNs) can transfer funds internationally through designated banking channels and remittance service providers. The process typically involves several steps, starting with initiating a transfer request with the NRN’s bank in Nepal. NRNs must provide details of the recipient’s bank account, including the account number, SWIFT code, and other relevant information.

The sending bank then processes the transfer request and converts the funds into the desired currency using the prevailing exchange rates. Once the transfer is approved, the funds are electronically transferred to the recipient’s bank account overseas.

Are there currency exchange regulations?

Yes, currency exchange regulations exist in Nepal, overseen by the Nepal Rastra Bank (NRB). These regulations govern the conversion of Nepalese currency (Nepalese Rupee) into foreign currency and vice versa. Non-Resident Nepalis (NRNs) must adhere to these regulations when repatriating funds from Nepal.

The NRB sets exchange rates and may impose restrictions or limits on currency conversion to maintain stability in the foreign exchange market. NRNs must conduct currency exchanges through authorized dealers, such as commercial banks or licensed money changers, ensuring compliance with regulatory requirements.

How to handle repatriation disputes?

Non-Resident Nepalis (NRNs) should first attempt to resolve the issue through direct communication with the relevant parties, such as the Nepal Rastra Bank (NRB), commercial banks, or other involved entities. If informal resolution attempts fail, NRNs may seek legal recourse by engaging legal counsel familiar with Nepalese laws and regulations governing repatriation.

What is the role of banks in repatriation?

Banks serve as intermediaries between NRNs and regulatory authorities, such as the Nepal Rastra Bank (NRB). Banks assist NRNs in submitting repatriation requests, verifying documentation, and obtaining necessary approvals from regulatory authorities.

Additionally, banks provide foreign exchange services, converting Nepalese currency into foreign currency for repatriation purposes. They also facilitate international fund transfers for the transmission of funds to NRNs’ designated overseas bank accounts.

Are there government guidelines for repatriation?

Yes, the government of Nepal provides comprehensive guidelines for repatriation, primarily regulated by the Nepal Rastra Bank (NRB). It outlines the procedures, documentation requirements, and compliance standards for Non-Resident Nepalis (NRNs) to repatriate funds from Nepal.

How to verify repatriation transactions?

Non-Resident Nepalis (NRNs) can verify repatriation transactions by maintaining detailed records of all correspondence, approvals, and financial documents related to the repatriation process. They should cross-reference these documents with their bank statements and transaction records to confirm that the funds have been transferred successfully to their designated overseas bank accounts.

What are the benefits of repatriation?

Repatriation benefits Non-Resident Nepali (NRN’s) as they can reinvest in opportunities with potentially higher returns or better growth prospects. Repatriation also allows NRNs to access their funds for personal or business use, such as education, healthcare, or entrepreneurial ventures.

How to comply with repatriation laws?

Compliance with Repatriation Laws means compliance with the repatriation guidelines set by the Nepal Rastra Bank, Foreign Investment and Technology Transfer Act 2019 and other applicable repatriation laws and regulations.

NRNs should maintain meticulous records of their repatriation transactions and communicate regularly with their banks or financial advisors to stay updated on any changes in repatriation laws or procedures.

Conclusion

Non-Resident Nepalis (NRNs) are permitted to repatriate investments from Nepal through Nepal Rastra Bank (NRB), subject to specific procedures. NRNs must submit a repatriation request, including investment proof, to the NRB for approval. Required documents include investment evidence, tax clearance certificates, and identification papers.

Repatriation has restrictions, such as periodic limits and tax obligations. Profits from investments can be repatriated. Repatriation benefits NRNs by enabling reinvestment and accessing funds for personal or business purposes.

FAQs

Can NRNs repatriate investments from Nepal?

Yes, NRNs can transfer dividends, profits, and sale proceeds of investments from Nepal back to their country of residence.

What is the process for NRN Investment Repatriation from Nepal?

Step 1: Submit a Repatriation Request to NRB

Step 2: Submit Required Documents

Step 3: Get Approval from NRB

Step 4: Transfer Funds through designated Commercial Bank

What documents are needed for NRN Investment Repatriation?

Provide a repatriation request form, proof of investment, income evidence, tax clearance, passport, NRN ID, and company documents if applicable.

How long does repatriation take?

Typically a few business weeks to months for fund transfer after NRB approval, subject to document verification and compliance checks.

Are there repatriation fees?

Yes, fees may apply including currency conversion charges by banks and regulatory fees by the NRB.

How to get NRN Investment Repatriation approval?

Complete a repatriation request form, submit documents to the NRB, await approval, and transfer funds through designated banks.

Can profits be repatriated?

Yes, NRNs can repatriate profits from dividends, interest, or capital gains earned on investments in Nepal.